As the African market continues to attract the attention of international operators, there is a growing demand for pan-African regulation, writes Yahaya Maikori. Whether that is justified, or indeed possible, remains unclear.

This sentiment is borne directly from the European experience. If such a proposition is not remotely possible in North America, or even Asia, why is it being called for in Africa? Why should an entire continent be subject to a single regulatory framework?

It’s borne out of ignorance, when everyday conversations can include phases such as “I am going to Africa” or “I have never been to Africa”. The continent is not a single entity.

The term “Africa” conceals much of the continent’s diversity paradoxes. For example, there is different jurisprudence governing the various legal systems of the 54 African nations. North Africa, comprising seven countries, is primarily based on Islamic law, which is morally against gambling.

In Egypt, for example, gambling is banned outright, though for tourism purposes they have made exceptions to allow foreigners to patronise casinos, while sports betting thrives illegally. Morocco, though a Muslim country, surprisingly allows almost all forms of gambling – perhaps the mixture of Islamic, European and African influences, coupled with a thriving tourism industry, accounts for this tolerance.

Though both countries share a common jurisprudence, its application in each country is very different. As liberal as the Morocco may seem to be, I doubt that it will ever legislate for gambling industry.

In West Africa, only five members of the 17 Economic Community of West African States (ECOWAS) speak English as their official language. The rest are predominantly French, sprinkled with a few Portuguese and Dutch-speaking countries. Though intended to create a regional market, poor transportation connections, poor implementation of the various protocols and poor communication arising from language barrier has substantially hampered intraregional commerce between the member countries.

Ordinarily language shouldn’t be a barrier for trade in contemporary times, but in Africa languages have deeper cultural, social, moral and traditional significance compared to Europe which can derail such initiatives.

A cursory look at the various markets also indicates that legislative activity seems to grow along the same direction as their most active sub-sectors to the exclusion of the less vibrant ones.

For clarity, South Africa’s probably has the most mature gambling market on the continent. Yet despite the surge in payment providers and remote gaming it has refused to address remote gambling in its current draft law.

In Nigeria, online sports betting is recognised though it is yet to be regulated, but since sports betting has grown exponentially other sub-sectors such casino and slots – which were a big thing barely 30 years ago – have been neglected.

In any case, since the gambling sector’s significance is only just becoming apparent in most economies, it is yet to be recognised as an industry that warrants most African governments’ attention.

Having considered these challenges are there any viable vehicles for the advancement of this proposition? Perhaps African Union’s (formerly known as the Organization of African Unity), new initiative, known as the Africa continental free trade agreement (AFCTA) which seeks to organise Africa into one market, has the capacity to provide a vehicle for such an effort.

African Union (AU) has shifted its focus from addressing Africa’s political challenges to addressing its economy, which is projected to be worth $5tb when properly harnessed.

Intra-African commerce is currently estimated to comprise 15% of the continent’s trade, compared to Europe’s 71%. Not even the growth of ecommerce has improved intra-continental trade – a result of the fragmented nature of the continent’s economy and its infrastructural deficits, especially in information and communications technology.

AU’s initiative provides some hope but there are already fears on how to harmonise Africa’s heterogeneous economies, especially those with the largest income disparities. While opportunities for ecommerce are at the forefront of the ongoing negotiations, the reality is that the journey has just began and gambling will not be a priority in those negotiations.

With the above situation we are left with probably one likely vehicle, the Gaming Regulators Africa Forum (GRAF) – a platform for Africa regulators. It may hopefully be able to provide a possible solution by ensuring uniformity of regulation amongst all its members. Uniform regulation across most of Africa, though far from the ideal proposition, provides at least some certainty as to what to expect in most African markets in terms licensing and taxation, as well as legal certainty for operators.

Perhaps this is the first step towards establishing some form of pan African regulation.

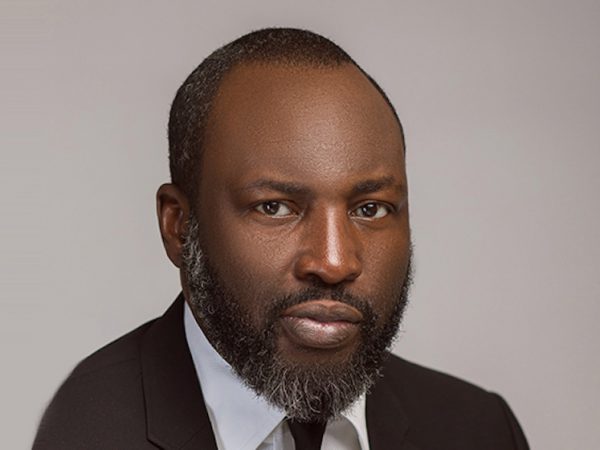

Yahaya Maikori is the senior partner of Law Allianz, a leading African gaming and entertainment law firm. He also co- founded Global Gaming Group, a business that has advised regulators, companies, and startups across key markets in Africa’s growing gaming industry.